rastreandovalor.blogspot.pt/2018/05/berkshire-un-gigante.html

Warren Buffett - Berkshire Hathaway

Period: Q4 2018

Portfolio date: 31 Dec 2018

No. of stocks: 48

Portfolio value: $183,066,067,000

Portfolio date: 31 Dec 2018

No. of stocks: 48

Portfolio value: $183,066,067,000

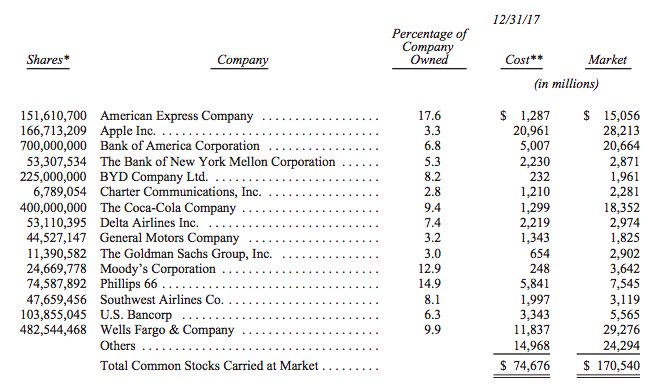

| History | Stock | % of portfolio | Shares | Recent activity | Reported Price* | Value |

| ≡ | AAPL - Apple Inc. | 21.51 | 249,589,329 | Reduce 1.14% | $157.74 | $39,370,221,000 |

| ≡ | BAC - Bank of America Corp. | 12.06 | 896,167,600 | Add 2.16% | $24.64 | $22,081,569,000 |

| ≡ | WFC - Wells Fargo | 10.74 | 426,768,902 | Reduce 3.52% | $46.08 | $19,665,511,000 |

| ≡ | KO - Coca Cola Co. | 10.35 | 400,000,000 | $47.35 | $18,939,999,000 | |

| ≡ | AXP - American Express | 7.89 | 151,610,700 | $95.32 | $14,451,533,000 | |

| ≡ | KHC - Kraft Heinz Co. | 7.66 | 325,634,818 | $43.04 | $14,015,323,000 | |

| ≡ | USB - U.S. Bancorp | 3.23 | 129,308,831 | Add 3.51% | $45.70 | $5,909,415,000 |

| ≡ | JPM - JPMorgan Chase & Co. | 2.67 | 50,116,394 | Add 40.52% | $97.62 | $4,892,364,000 |

| ≡ | BK - Bank of New York | 2.08 | 80,937,250 | Add 3.97% | $47.07 | $3,809,716,000 |

| ≡ | MCO - Moody's Corp. | 1.89 | 24,669,778 | $140.04 | $3,454,756,000 | |

| ≡ | DAL - Delta Air Lines Inc. | 1.79 | 65,535,000 | $49.90 | $3,270,197,000 | |

| ≡ | GS - Goldman Sachs Group | 1.67 | 18,353,635 | $167.05 | $3,065,974,000 | |

| ≡ | LUV - Southwest Airlines | 1.39 | 54,847,399 | Reduce 2.14% | $46.48 | $2,549,307,000 |

| ≡ | GM - General Motors | 1.32 | 72,269,696 | Add 37.76% | $33.45 | $2,417,421,000 |

| ≡ | CHTR - Charter Communications | 1.09 | 7,033,499 | Reduce 4.19% | $284.97 | $2,004,336,000 |

| ≡ | DVA - DaVita HealthCare Partners | 1.08 | 38,565,570 | $51.46 | $1,984,584,000 | |

| ≡ | VRSN - Verisign Inc. | 1.05 | 12,952,745 | $148.29 | $1,920,763,000 | |

| ≡ | UAL - United Continental Holdings | 1.00 | 21,938,642 | Reduce 15.57% | $83.73 | $1,836,922,000 |

| ≡ | USG - USG Corp. | 0.91 | 39,002,016 | $42.66 | $1,663,826,000 | |

| ≡ | AAL - American Airlines Group Inc. | 0.77 | 43,700,000 | $32.11 | $1,403,208,000 | |

| ≡ | V - Visa Inc. | 0.76 | 10,562,460 | $131.94 | $1,393,611,000 | |

| ≡ | LSXMK - Liberty SiriusXM Series C | 0.63 | 31,090,985 | $36.98 | $1,149,744,000 | |

| ≡ | PSX - Phillips 66 | 0.56 | 11,895,842 | Reduce 22.92% | $86.15 | $1,024,826,000 |

| ≡ | PNC - PNC Financial Services | 0.53 | 8,263,062 | Add 35.74% | $116.91 | $966,034,000 |

| ≡ | MA - Mastercard Inc. | 0.51 | 4,934,756 | $188.65 | $930,942,000 | |

| ≡ | COST - Costco Co. | 0.48 | 4,333,363 | $203.71 | $882,749,000 | |

| ≡ | SIRI - Sirius XM Holdings Inc. | 0.43 | 137,915,729 | $5.71 | $787,499,000 | |

| ≡ | MTB - M&T Bank Corp. | 0.42 | 5,382,040 | $143.13 | $770,331,000 | |

| ≡ | RHT - Red Hat Inc. | 0.40 | 4,175,792 | Buy | $175.64 | $733,436,000 |

| ≡ | TRV - Travelers Companies Inc. | 0.39 | 5,958,391 | Add 68.14% | $119.75 | $713,517,000 |

| ≡ | TEVA - Teva Pharmaceutical Industries Ltd. | 0.36 | 43,249,295 | $15.42 | $666,905,000 | |

| ≡ | AXTA - Axalta Coating Systems Ltd. | 0.31 | 24,264,000 | $23.42 | $568,263,000 | |

| ≡ | LSXMA - Liberty Sirius XM Series A | 0.30 | 14,860,360 | $36.80 | $546,862,000 | |

| ≡ | STOR - STORE Capital Corp. | 0.29 | 18,621,674 | $28.31 | $527,180,000 | |

| ≡ | SYF - Synchrony Financial | 0.27 | 20,803,000 | $23.46 | $488,038,000 | |

| ≡ | TMK - Torchmark Corp. | 0.26 | 6,353,727 | $74.53 | $473,544,000 | |

| ≡ | QSR - Restaurant Brands International | 0.24 | 8,438,225 | $52.30 | $441,319,000 | |

| ≡ | LBTYA - Liberty Global Inc. | 0.23 | 19,791,000 | $21.34 | $422,340,000 | |

| ≡ | SU - Suncor Energy Inc. | 0.16 | 10,758,000 | Buy | $27.97 | $300,901,000 |

| ≡ | STNE - StoneCo Ltd. | 0.14 | 14,166,748 | Buy | $18.44 | $261,235,000 |

| ≡ | LBTYK - Liberty Global Inc. C | 0.08 | 7,346,968 | $20.64 | $151,641,000 | |

| ≡ | LILA - Liberty LiLAC Group A | 0.02 | 2,714,854 | $14.48 | $39,311,000 | |

| ≡ | PG - Procter & Gamble | 0.02 | 315,400 | $91.92 | $28,992,000 | |

| ≡ | JNJ - Johnson & Johnson | 0.02 | 327,100 | $129.05 | $42,212,000 | |

| ≡ | LILAK - Liberty LiLAC Group C | 0.01 | 1,284,020 | $14.57 | $18,708,000 | |

| ≡ | MDLZ - Mondelez International | 0.01 | 578,000 | $40.03 | $23,137,000 | |

| ≡ | VZ - Verizon Communications | 0.00 | 928 | $56.03 | $52,000 | |

| ≡ | UPS - United Parcel Service | 0.00 | 59,400 | $97.53 | $5,793,000 |

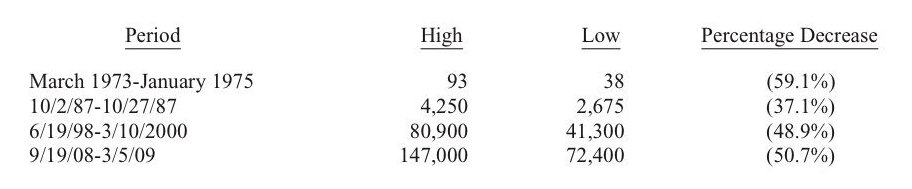

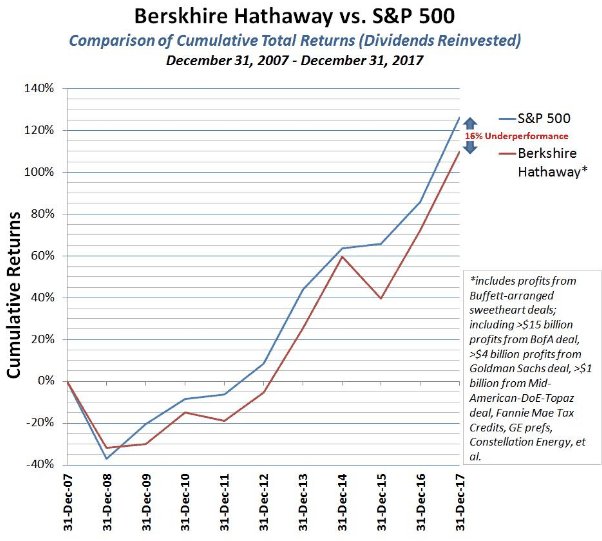

Pérdidas temporales soportadas por W. Buffett :

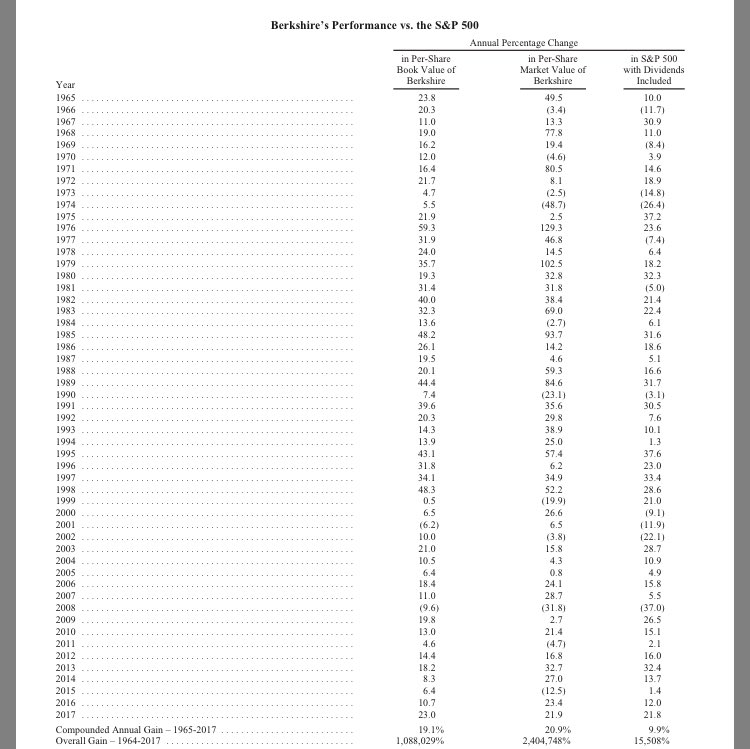

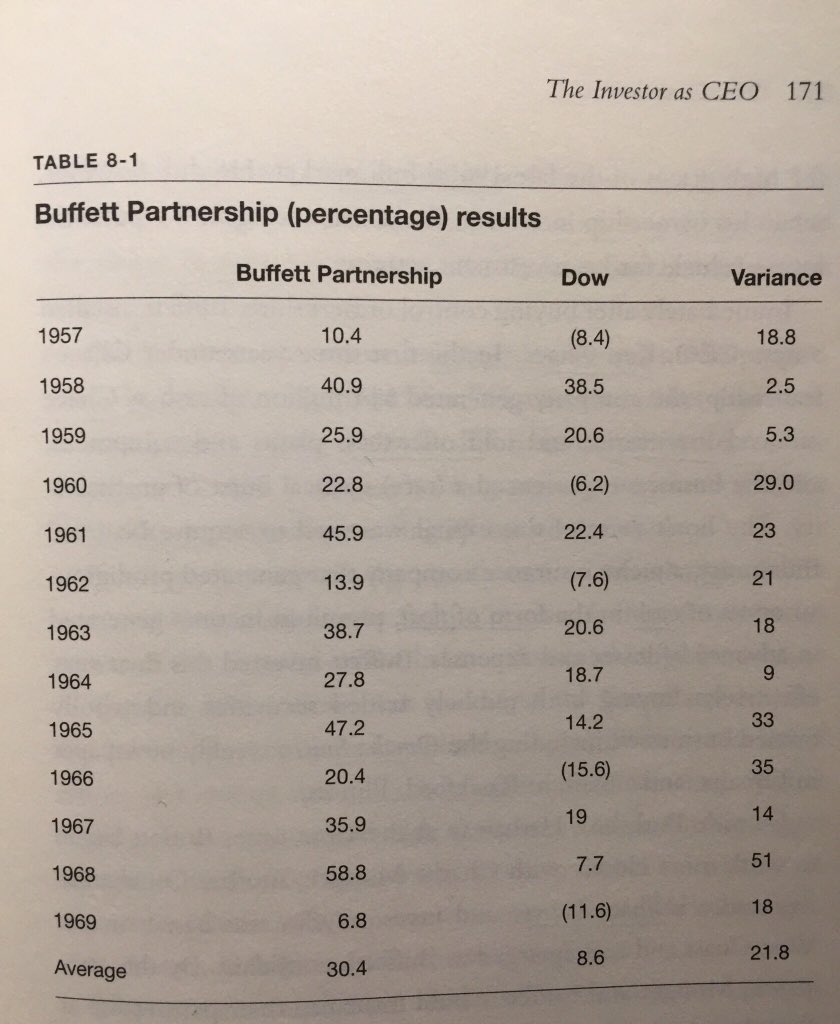

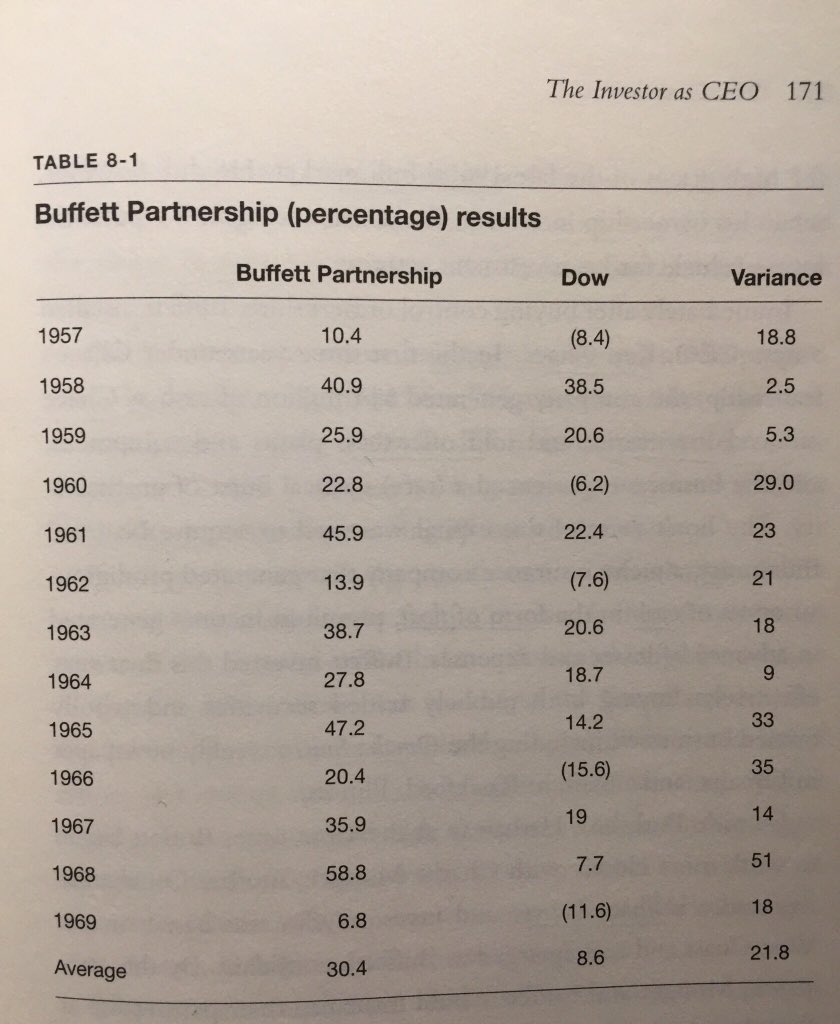

Resultados anuales de Warren Buffett :

Cartas anuales 1957-1969:

focusedcompounding.com/wp-content/uploads/2018/04/Complete_Buffett_partnership_letters-1957-70.pdf

______ _______________________________________________________________________________________

_______________________________________________________________________________________

_______________________________________________________________________________________

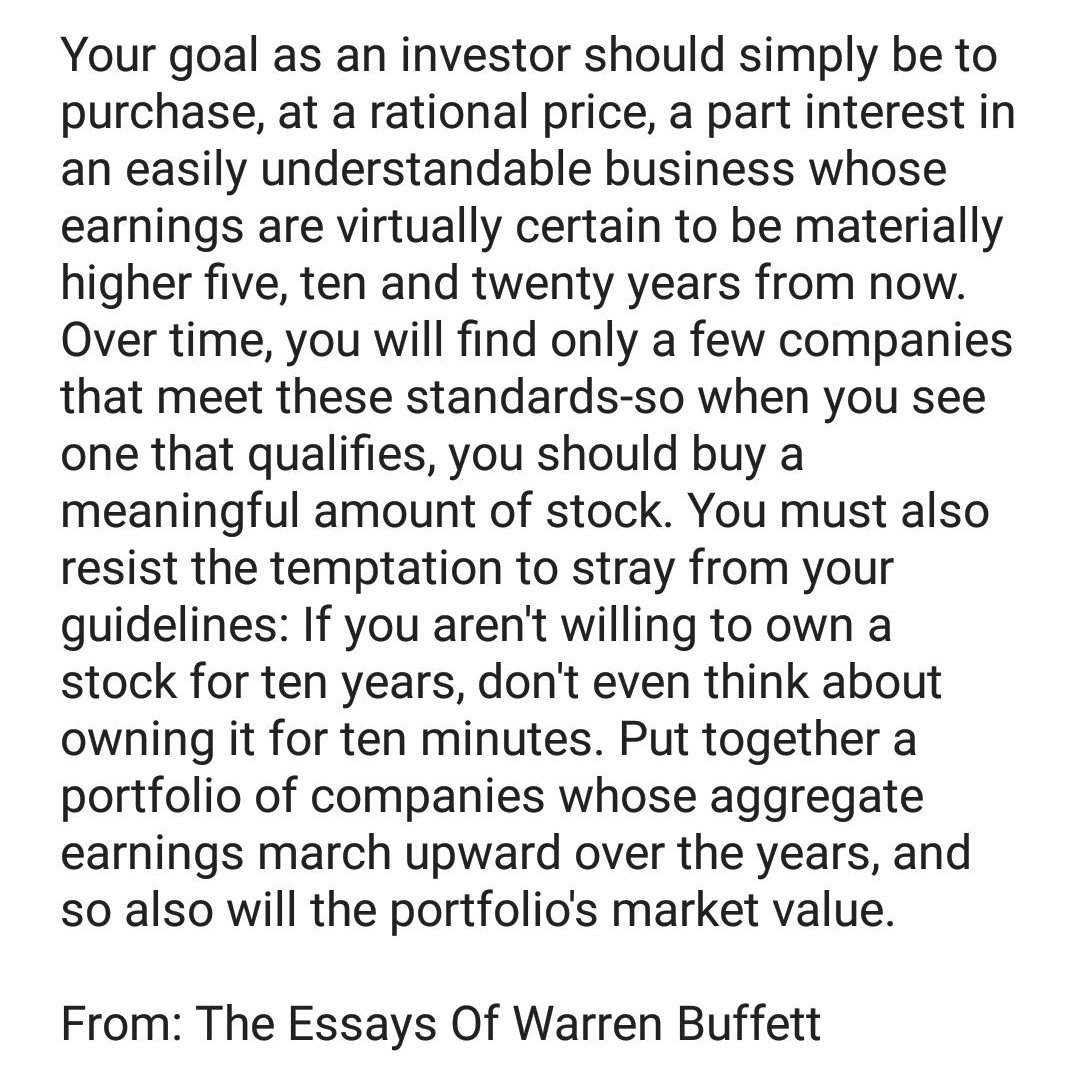

_______________________________________________________________________________________Frases para guardar del veterano inversor:

"El miedo generalizado es tu amigo, el miedo personal es tu enemigo"

"No se puede comprar lo que es popular y hacerlo mejor que lo demas"

Holger Zschaepitz @Schuldensuehner

No hay comentarios:

Publicar un comentario