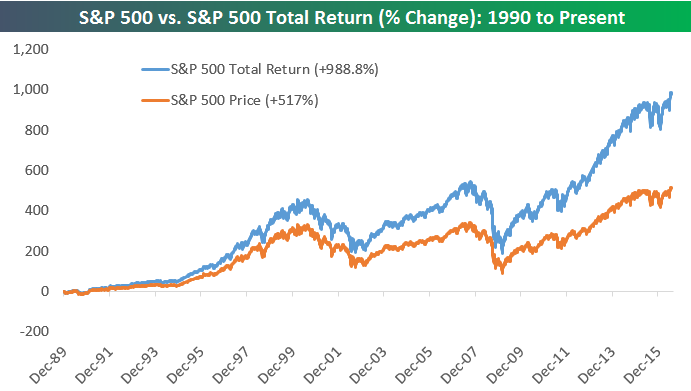

Fuente: bespokepremium.com

If you want to see how important dividends are to equity market performance, look no further than the S&P 500 total return index, which factors in the index’s dividends and re-invests them. Going back to 1990, the S&P 500 price index is up 517%. The S&P 500 total return index is up just about double that at 989%, and it has exploded higher over the last four years. This should be exhibit A when explaining the importance of dividend yields as well as long-term buy and hold.

No hay comentarios:

Publicar un comentario