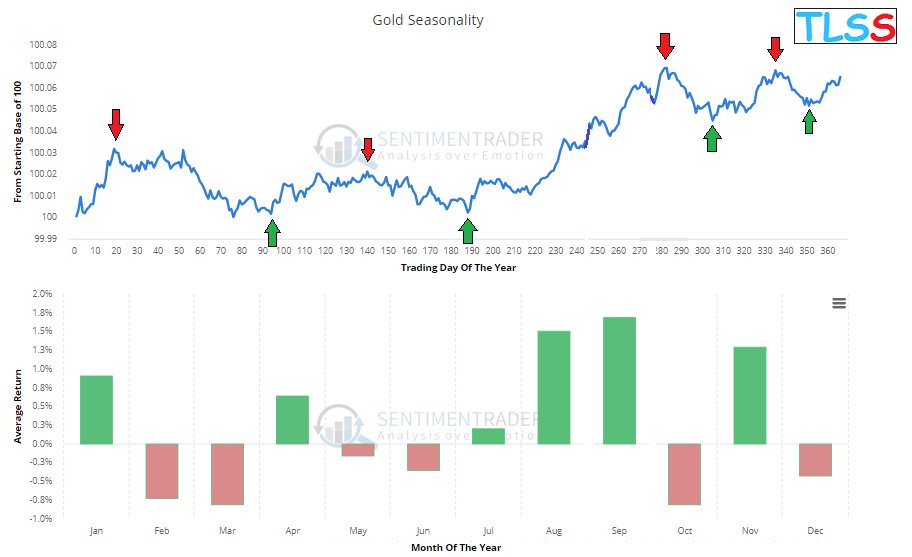

Estacionalidad del oro:

www.safehaven.com/article/44813/the-cycle-of-falling-interest-gold-and-silver-report

Gold, performance by days of the week, 2000 to 2017:

Gold, cumulative performance by days of the week, 2000 to 2017, indexed:

HUI, performance by days of the week, 2000 to 2017:

HUI, cumulative performance by days of the week, 2000 to 2017, indexed:

Puede subir ETF oro y que corrijan las mineras:

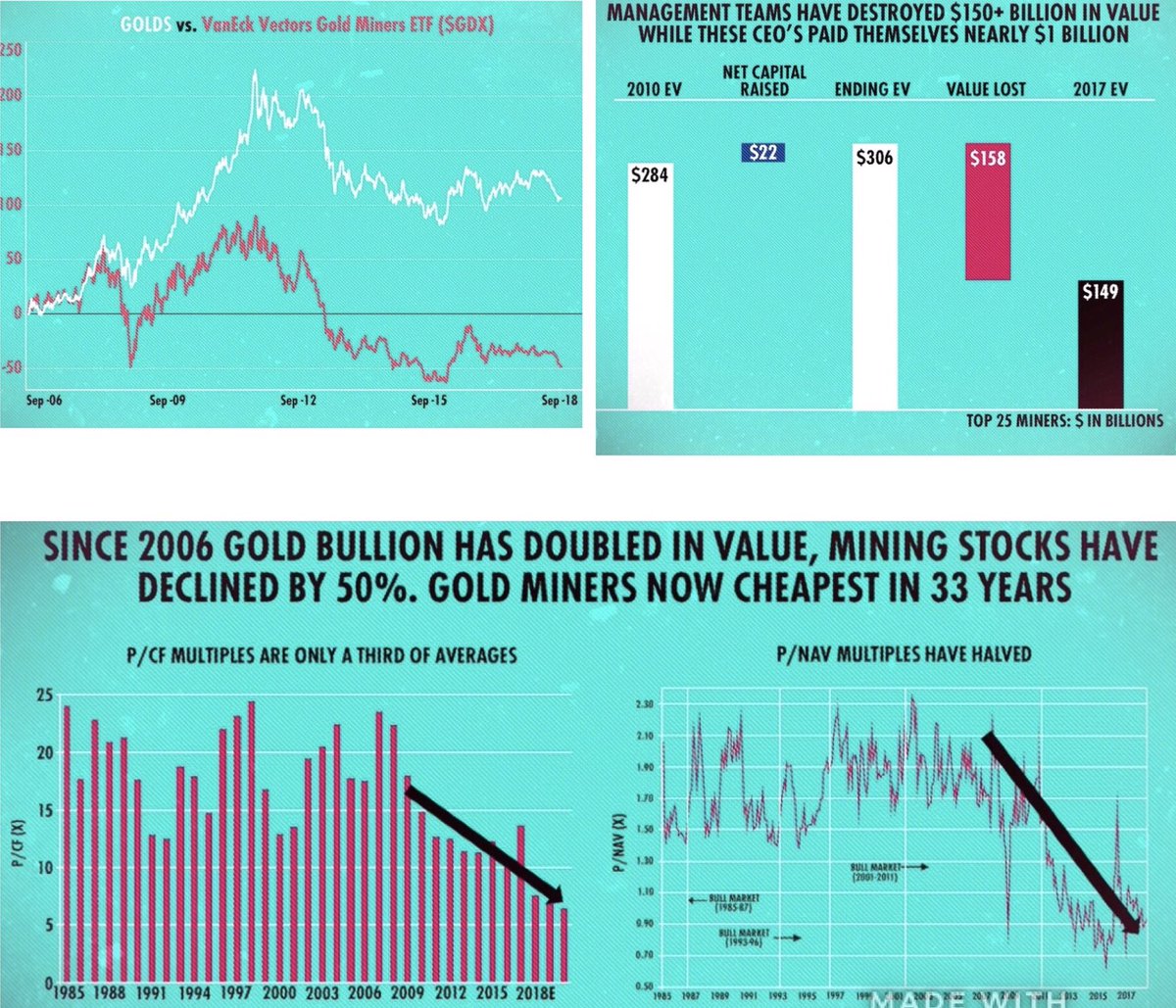

For starters, there is no formula that states that the Miners have to return x% of Gold. They are not commodities but stocks, and as such their returns are dictated by dividends, earnings growth and multiple expansion/contraction. While these factors are undoubtedly influenced by the price of Gold, they are not ruled by the price of Gold. As we have seen since 2006, the price of Gold can go up and if the Mining companies are poorly managed and multiples contract, their stocks can certainly go down.

¿ETF mineras protege caídas del SP500?

Gold tends to be up (on average) when the S&P 500 is down, as evidenced by its Downside Capture of -27% (translation: Gold is up on average 0.27 times the S&P 500’s decline). By extension, many assume that the Gold Miners display a similar if not enhanced profile.

The problem is that Gold Mining stocks are still stocks, and while they may have a low correlation to the S&P 500 (0.17), the correlation is still positive. Since its inception in 2006, GDX has a Downside Capture of 60% versus the S&P 500 and has been down 53% of the time when the S&P 500 is down. It has basically been worse than a coin flip to bet that Gold Miners will be up in a down market for stocks broadly.

That’s not to say that the Miners can’t be a hedge at times. They certainly can be, as they are up 47% of the time when the S&P 500 is down. But one can hardly say that they are a “good hedge” when they are down 38% in October 2008, one of the worst months in history for the S&P 500 (-16.5%).

No hay comentarios:

Publicar un comentario