Fuente: Bespoke

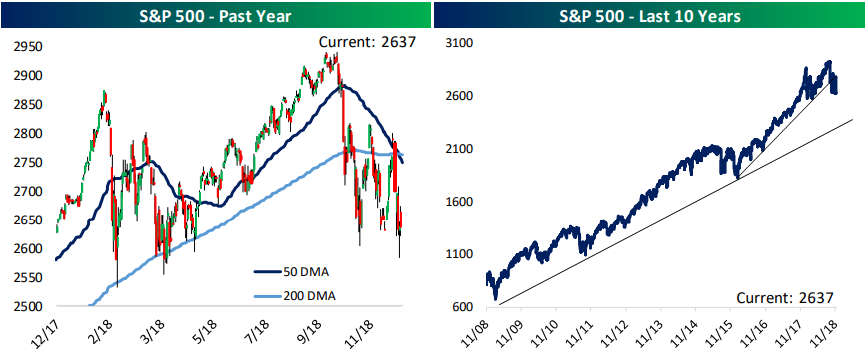

The S&P 500 (U.S.) has so far managed to hold above support at 2,600, while its 10-year chart still looks relatively bullish.

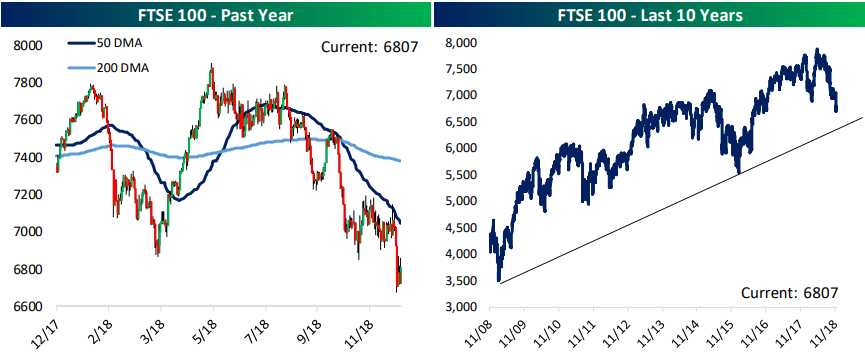

The FTSE 100 (UK) is in a nasty multi-month downtrend with a recent break to new 52-week lows, but price has still yet to test the bottom of its 10-year uptrend channel.

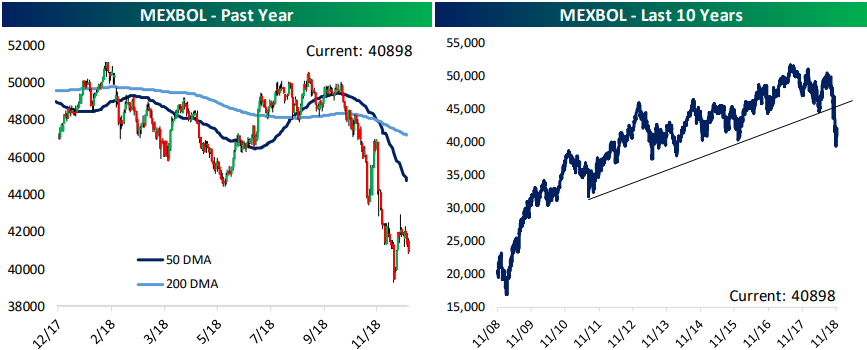

Mexico’s Bolsa index has plummeted 20% from its recent highs, and this drop also broke a key support level on its 10-year chart as well.

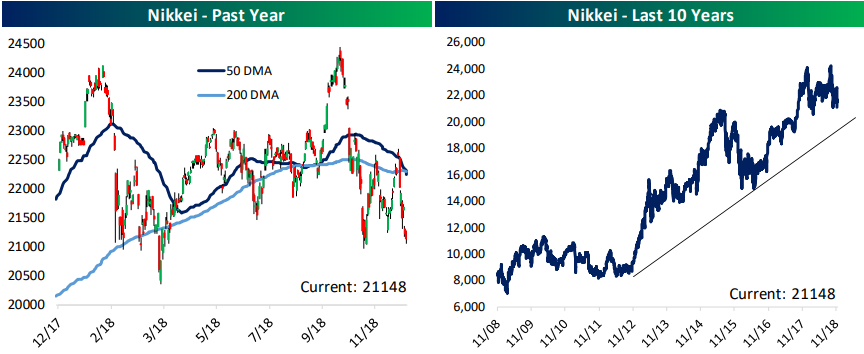

Japan’s Nikkei 225 looks somewhat similar to the chart for the S&P 500. The index has been choppy over the last year but hasn’t made a new 52-week low, and it remains well within its 10-year uptrend channel.

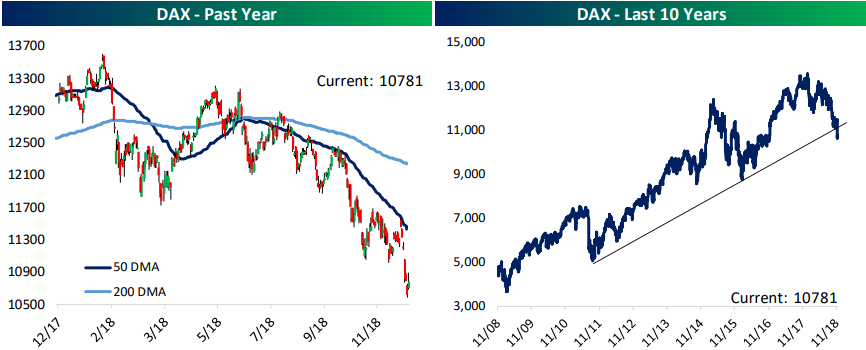

The German DAX index looks very negative on both a short-term and long-term technical basis. As shown, the index is a falling knife on the one-year chart, and it just broke below its long-term uptrend channel on the 10-year chart.

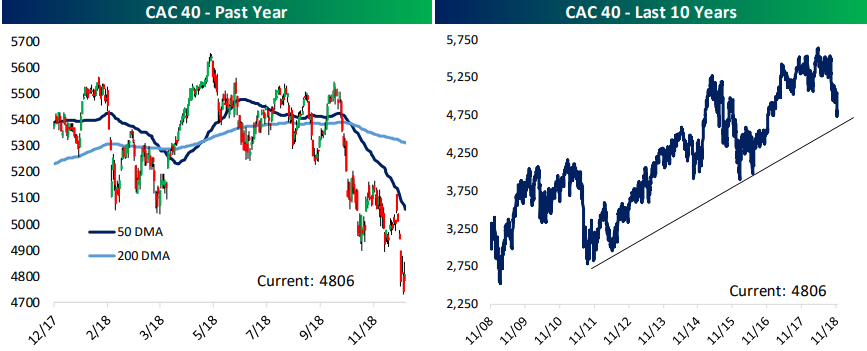

While Germany’s DAX has broken down on a 10-year chart, France’s CAC 40 remains slightly above the bottom of its long-term uptrend channel.

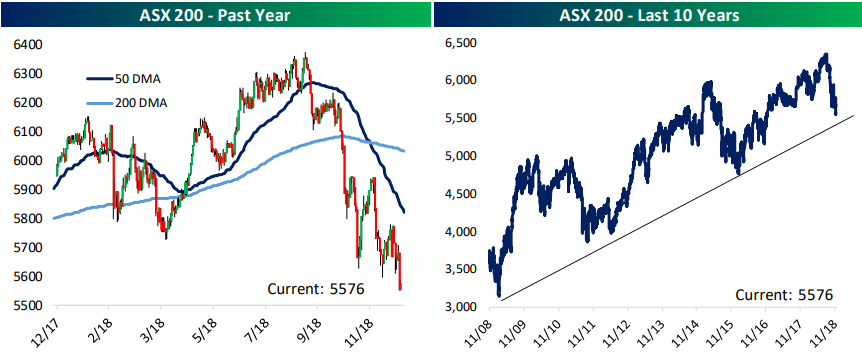

Like the French CAC 40, Australia’s ASX 200 has recently made a 52-week low, but it remains above the bottom of its 10-year uptrend channel.

No hay comentarios:

Publicar un comentario