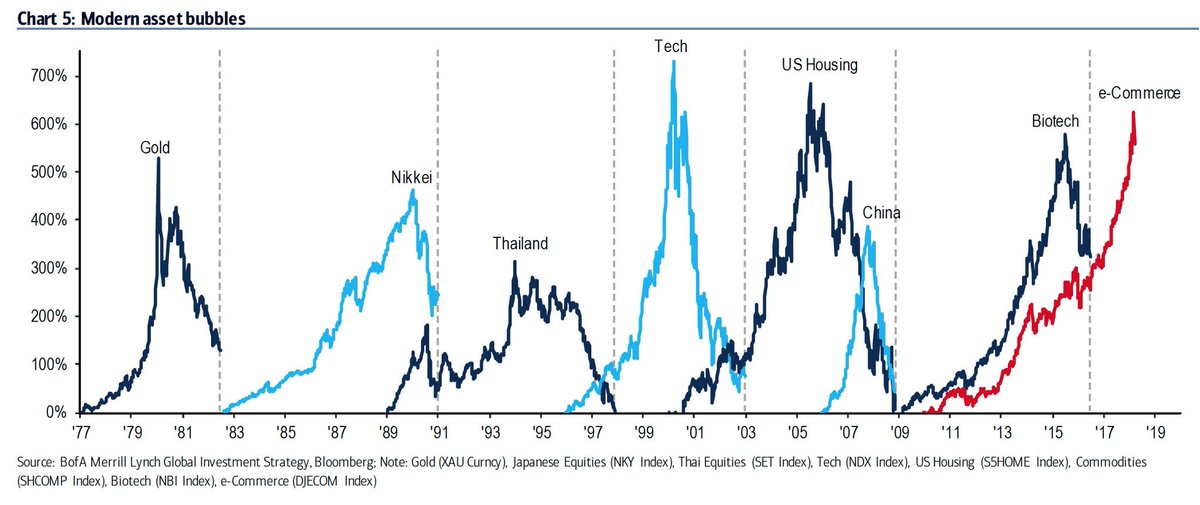

BofAML sees tech in a bubble: US internet stocks soared 624% in 7yrs at their peak, 3rd largest rally of past 40yrs. US tech mkt cap ($6.4tn) exceeds that of Eurozone ($5.0tn). Tech cash-rich, tax-light: sector has $740bn of cash overseas, larger than all other sectors together.

"10 reasons why global investors should reduce tech allocations in 2018" which are as follows:

- 1. Excess returns & fancy valuations: US tech is best performing sector in QE era, up annualized 20%; ex tech the S&P500 would be 2000 not 2600 today

- 2. Bubbly prices: US internet commerce stocks (DJECOM) soared 624% in 7 years at their peak, 3rd largest bubble of past 40 years (see chart above)

- 3. Fat market caps: US tech market cap ($6.4tn) exceeds that of Eurozone ($5.0tn); FAAMG+BAT market cap of $4.9tn exceeds Emerging Markets ($4.6tn).

- 4. Earnings hubris: tech & eCom companies currently account for almost 1/4 of US EPS (Chart 6); this level that is rarely exceeded, and often associated with bubble peaks; note there are currently just 5 “sells” out of 250 FAAMG recommendations

- 5. Politics: privacy becoming policy issue as equivalent to entire global population searches Google every 2 days; last year 1579 “data breaches” exposed 179 million records of personal names plus financial or medical data; pending US & EU regulation threaten 4% of tech revenue.

- 6. Wage disruption: IMF says 50% of the decline in labor’s share of income is attributable to technology (25% due to globalization); number of global industrial robots by 2020 will be 3.1 million (was 1 million in 2010)

- 7. Tech is cash-rich, tax-light: sector has $740bn of cash overseas (larger than all other sectors put together ($510bn); effective rate of tax on US tech companies is 16.9%, lower than the 19.3% paid across the S&P500

- 8. Tech most lightly regulated sector: just 27K regulations (Chart 7) for tech; by comparison manufacturing regulated by 215K rules, financial sector by 128K.

- 9. Tech & trade: US tech has highest foreign sales exposure (58%) of all US sectors

- 10. Occupy Silicon Valley: tobacco (1992), financial (2010), biotech (2015) industries illustrate how waves of regulation can lead to investment underperformance.

No hay comentarios:

Publicar un comentario